transfer taxes refinance georgia

Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd. Intangible Tax 300 per thousand of the sales price.

10 Best Georgia Dream Mortgage Lenders Of 2022 Nerdwallet

I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing.

. Intangibles Mortgage Tax Calculator for State of Georgia. Georgia Transfer Tax Calculator. See GACode 48-6-1 Tax rate for real estate conveyance instruments Georgia Code 2013.

Refinance Mortgage Transfer Tax in Georgia. A property selling for. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

07th Sep 2010 0515 pm. ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. Rule 560-11-8-05 - Refinancing 1 Intangible recording tax is not required to be paid on.

In Georgia the average amount is 1897 for a 200000 mortgage. The State of Delaware transfer tax rate is 250. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

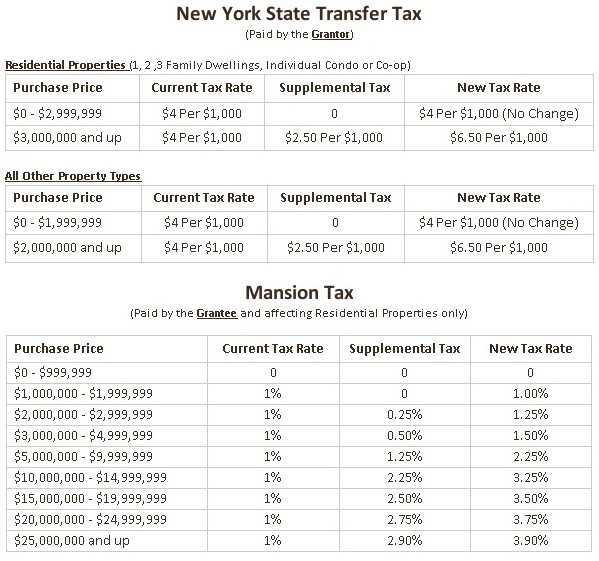

Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza. Refinance Property taxes are due in November. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

Delaware DE Transfer Tax. 1 Intangible recording tax is not required to be paid on that part of the face. Current through Rules and Regulations filed through July 7 2022.

The percentage will vary depending on what the city county or state. Seller Transfer Tax Calculator for State of Georgia. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

The transfer tax is calculated as a percentage of the sale price or the appraised value of the property. Subject 560-11-8 INTANGIBLE RECORDING TAX Rule 560-11-8-01 Purpose of Regulations. Purchasing a home in Georgia.

Rule 560-11-8-05 - Refinancing. These regulations have been adopted by the Commissioner pursuant to OCGA. Georgia Transfer Tax 100 per thousand of sales.

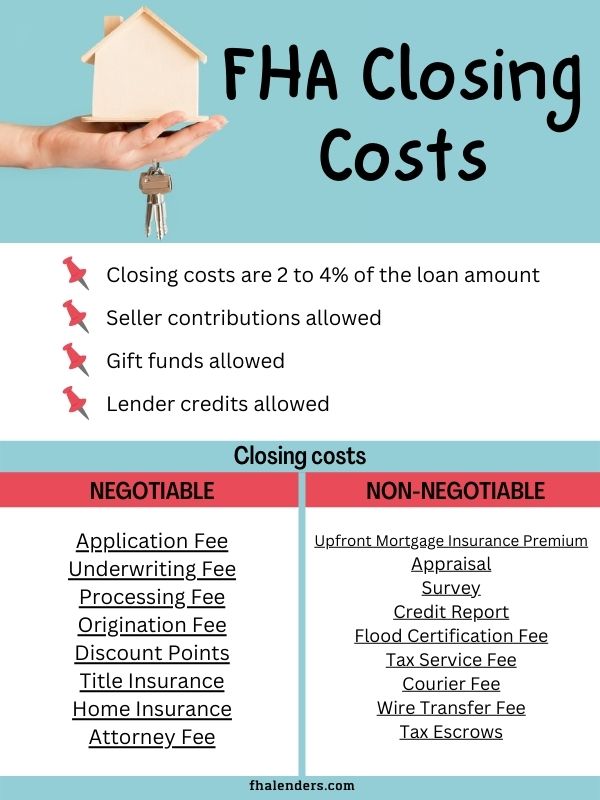

Fha Closing Costs Complete List And Estimate Fha Lenders

Texas Real Estate Transfer Taxes An In Depth Guide

Mortgage Calculator Georgia New American Funding

Attorney Refinance Closings Made Simple Georgia Closing Pro Title Escrow Llc

Dekalb County Ga Property Tax Calculator Smartasset

Refinancing And Intangible Tax Origin Title Escrow Inc

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

Should I Transfer The Title On My Rental Property To An Llc

10 Best Mortgage Lenders In Georgia Nextadvisor With Time

Everything You Need To Know About Closing Costs In Georgia Newhomesource

What S A Transfer Tax Rsjohnsonlegal

Motor Vehicles Forsyth County Tax

Closing Costs In Georgia Everything You Need To Know Faulkner Law

Georgia Property Tax Liens Breyer Home Buyers